UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx☒ Filed by a Party other than the Registrant¨☐

Check the appropriate box:

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to §240.14a-12 |

Applied Materials, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| No fee required. |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| Fee paid previously with preliminary materials: |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Gary E. Dickerson PRESIDENT AND CHIEF EXECUTIVE OFFICER |  |

February 18, 2015

January 25, 2018

Dear Applied Materials Stockholder:

Fellow Shareholders:

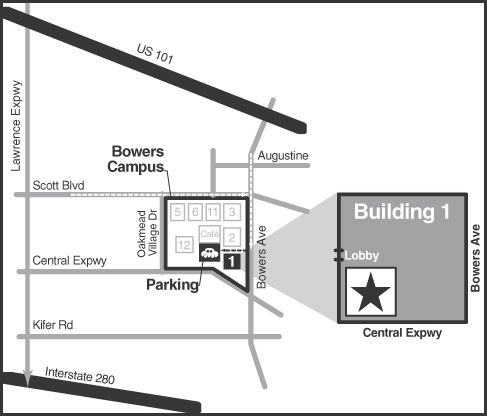

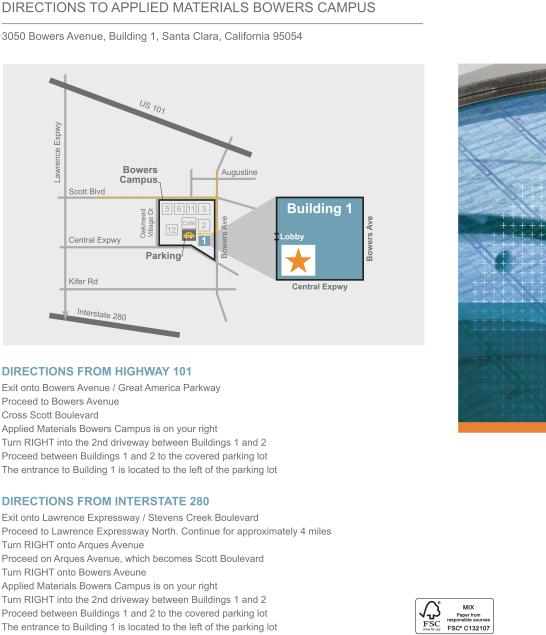

We cordially invite you to attend Applied Materials’ 20152018 Annual Meeting of Stockholders,Shareholders, which will be held on Thursday, April 2, 2015March 8, 2018, at 11:00 a.m. Pacific Time at our corporate offices at 3050 Bowers Avenue, Building 1, Santa Clara, California 95054.

At this year’s Annual Meeting, stockholders will be asked to: elect ten directors; approve, on an advisory basis, the compensation of our named executive officers; and ratify the appointment of KPMG LLP as Applied Materials’ independent registered public accounting firm for fiscal year 2015. Additional information about the Annual Meeting can be found in theThe attached Notice of 20152018 Annual Meeting of StockholdersShareholders and Proxy Statement describe the business to be conducted at the Annual Meeting. We have also made available a copy of our 2017 Annual Report on Form10-K with the Proxy Statement.

Your vote is very important to us, and voting your proxy will ensure your representation at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, we hopeurge you willto vote as soon as possible. Votingpossible and submit your proxy will ensure your representation atvia the Annual Meeting. We urgeInternet, or if you requested to review carefully thereceive printed proxy materials, by telephone or by signing, dating and to vote: FOR each of the director nominees; FOR the approval, on an advisory basis, of the compensation of our named executive officers; and FOR ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2015.returning your proxy card.

Thank you for your attention to these important matters and for your continued support of and interest in Applied Materials, particularly as we work toward the completion of our proposed business combination with Tokyo Electron Limited.Depending on the expected timing of the closing of the business combination, we may adjourn or cancel the Annual Meeting.

Materials.

Sincerely,

Gary E. Dickerson

President and Chief Executive Officer

3050 Bowers Avenue Santa Clara, California 95054 Phone:(408) 727-5555 | Mailing Address: Applied Materials, Inc. 3050 Bowers Avenue P.O. Box 58039 Santa Clara, California 95052-8039 |

NOTICE OF 2015

2018 ANNUAL MEETING OF STOCKHOLDERSSHAREHOLDERS

Thursday, April 2, 2015March 8, 2018

at 11:00 a.m. Pacific Time

The 20152018 Annual Meeting of StockholdersShareholders of Applied Materials, Inc. will be held on Thursday, April 2, 2015March 8, 2018, at 11:00 a.m. Pacific Time at our corporate offices at 3050 Bowers Avenue, Building 1, Santa Clara, California 95054 to conduct the following items95054.

Items of business:Business

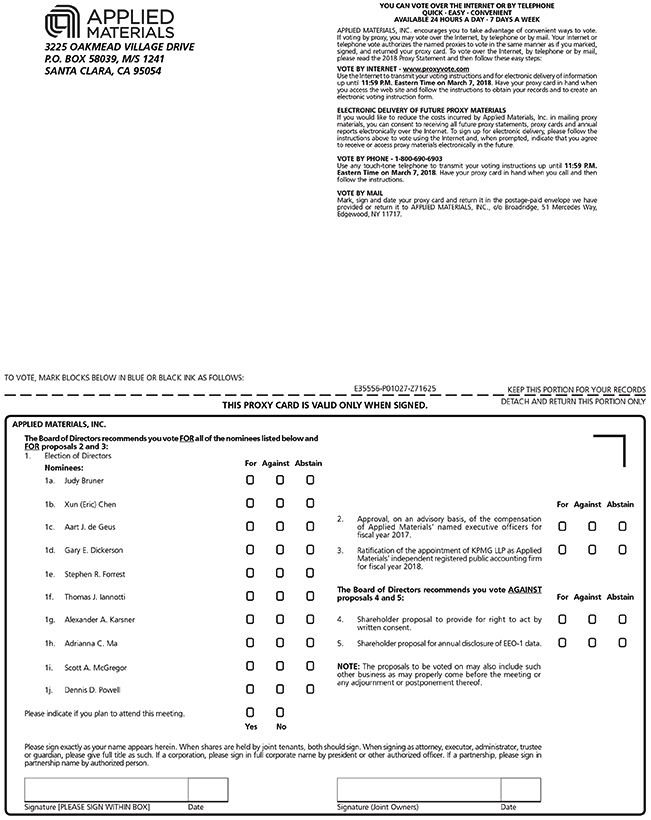

| 1. | To elect ten directors to serve for aone-year term and until their successors have been duly elected and qualified. |

| 2. | To approve, on an advisory basis, the compensation of our named executive |

| 3. | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year |

| 4. |

| 5. | To transact any other business that may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

Your vote is important. You may vote via the Internet or by telephone, or if you requested to receive printed proxy materials, by signing, dating and returning your proxy card. If you are voting via the Internet or by telephone, your vote must be received by 11:59 p.m. Eastern Time on Wednesday, March 7, 2018. For specific voting instructions, please refer to the information provided in the following Proxy Statement, together with your proxy card or the voting instructions you receive bye-mail or that are provided via the Internet.

If you received a Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”) on how to access the proxy materials via the Internet, a proxy card was not sent to you, and you may vote only via the Internet, unless you have requested a paper copy of the proxy materials, in which case, you may also vote by telephone or via the Internet.by signing, dating and returning your proxy card. Shares cannot be voted by marking, writing on and returning the Notice of Internet Availability. Any Notices of Internet Availability that are returned will not be counted as votes. Instructions for requesting a paper copy of the proxy materials are set forth on the Notice of Internet Availability. If you received a proxy card and other proxy materials by mail, you may vote by mailing a completed proxy card, by telephone or over the Internet. Your vote must be received by 11:59 p.m. Eastern Time on Wednesday, April 1, 2015. For specific voting instructions, please refer to the information provided in the following Proxy Statement, together with your proxy card or the voting instructions you receive by e-mail or that are provided via the Internet.

Please note that depending on the expected timing of the closing of the proposed business combination between Applied Materials, Inc. and Tokyo Electron Limited, the Annual Meeting may be adjourned or cancelled.

| By Order of the Board of Directors |

|

Thomas F. Larkins Corporate Secretary |

Santa Clara, California

February 18, 2015January 25, 2018

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on March 8, 2018: The Proxy Statement and Annual Report to Shareholders are available atwww.proxyvote.com.

PROXY STATEMENT

Reconciliation ofnon-GAAP adjusted financial measures used in the Compensation Discussion and Analysis section and elsewhere in this Proxy Statement, other than as part of disclosure of target levels, can be found in the Appendix.

2018 PROXY STATEMENT SUMMARY

20152018 PROXY STATEMENT SUMMARY

Your proxy is being solicited on behalf of the Board of Directors of Applied Materials, Inc. We are making this Proxy Statement available to shareholders beginning on January 25, 2018. This summary highlights information contained elsewhere in this Proxy Statement. We encourage you to read the entire Proxy Statement for more information about the topics to be considered at the Annual Meeting prior to voting.

Annual Meeting of Shareholders

ANNUAL MEETINGOF STOCKHOLDERS

|

| |

| Applied | |

| ||

| ||

| ||

Proposals and Board Recommendations

PROPOSALSAND VOTING RECOMMENDATIONS

|

| ||||||||||

| Board Recommendation | ||||||||||

| Proposal 1 – Election of Directors | Pages 1 to 6 | ✓ FOR each Nominee | |||||||||

| Stephen R. Forrest | Scott A. McGregor | |||||||||

Xun (Eric) Chen | Thomas J. Iannotti | Dennis D. Powell | |||||||||

Aart J. de Geus Gary E. Dickerson | Alexander A. Karsner Adrianna C. Ma | ||||||||||

| Proposal 2 – Executive Compensation | Page 19 | ✓ FOR | |||||||||

Approval, on an advisory basis, of the compensation of our named executive officers for fiscal year 2017 | |||||||||||

| Page 48 | ✓FOR | ||||||||||

| |||||||||||

| Proposal 4 – Shareholder Proposal to Provide for Right to Act by Written Consent | Pages 50 to 52 | ✘AGAINST | |||||||||

Shareholder proposal requesting that the Board take steps to permit shareholder action by written consent without a meeting | |||||||||||

| Proposal 5 – Shareholder Proposal for Annual Disclosure ofEEO-1 Data | Pages 53 to 55 | ✘ AGAINST | |||||||||

Shareholder proposal requesting that the Board adopt and enforce a policy to disclose annually Applied’sEEO-1 data | |||||||||||

Applied Materials, Inc. i

PROPOSAL 1—ELECTIONOF DIRECTORSDirector Nominees

Each

| Name and Occupation | Age | Director Since | Independent | Committees | ||||

| Judy Bruner | 59 | 2016 | ✓ | Governance (Chair) | ||||

Executive Vice President, Administration and Chief Financial Officer, SanDisk Corporation (retired) | Audit | |||||||

| Xun (Eric) Chen | 48 | 2015 | ✓ | Compensation | ||||

Chief Executive Officer, BaseBit Technologies, Inc. | Strategy | |||||||

| Aart J. de Geus | 63 | 2007 | ✓ | Strategy (Chair) | ||||

Chairman of the Board of Directors,Co-Chief Executive Officer, Synopsys, Inc. | Investment | |||||||

| Gary E. Dickerson | 60 | 2013 | ||||||

President and Chief Executive Officer, Applied Materials, Inc. | ||||||||

| Stephen R. Forrest | 67 | 2008 | ✓ | Audit | ||||

Professor of Electrical Engineering & Computer Science, Physics, and Materials Science & Engineering, University of Michigan | Strategy Investment | |||||||

| Thomas J. Iannotti | 61 | 2005 | ✓ | Compensation (Chair) | ||||

Senior Vice President and General Manager, Enterprise Services, Hewlett-Packard Company (retired) | ||||||||

| Alexander A. Karsner | 50 | 2008 | ✓ | Compensation | ||||

Managing Partner, Emerson Collective | Governance | |||||||

| Adrianna C. Ma | 44 | 2015 | ✓ | Investment (Chair) | ||||

Managing Partner, Fremont Group | Audit Governance | |||||||

| Scott A. McGregor | 61 | 2018 | ✓ | |||||

President and Chief Executive Officer, Broadcom Corporation (retired) | ||||||||

| Dennis D. Powell | 70 | 2007 | ✓ | Audit (Chair) | ||||

Executive Vice President, Chief Financial Officer, Cisco Systems, Inc. (retired) | Governance Investment |

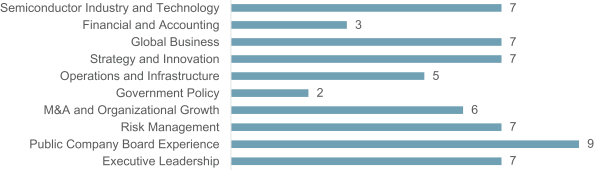

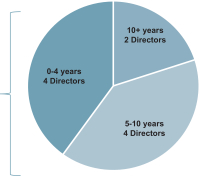

Board Practices and Composition

Ensuring the Board is composed of directors who possess a wide variety of relevant skills, professional experience and backgrounds, bring diverse viewpoints and perspectives, and effectively represent the long-term interests of shareholders, is a top priority of the Board and the Corporate Governance and Nominating Committee.

| Director Nominee Expertise | Key Attributes | |

|

|

ii 2018 Proxy Statement

Semiconductor Industry and Technology 6 Financial and Accounting 3 Global Business 6 Strategy and Innovation 6 Operations and Infrastructure 4 Government Policy 2 M&A and Organizational Growth 5 Risk Management 6 Public Company Board Experience 8 Executive Leadership 6 Independent Board Chair 89% Director Independence Regular refreshment resulting in average director tenure of 7 years

2018 PROXY STATEMENT SUMMARY

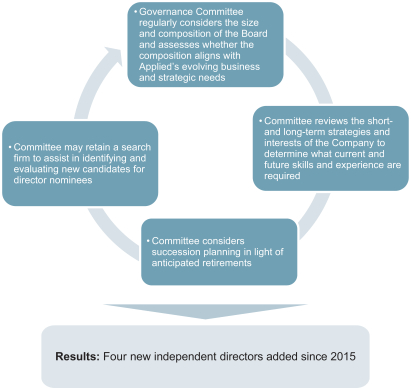

Board Practices Support Thoughtful Board Composition

Board Composition to Support Company Strategy |

The Board and the Corporate Governance and Nominating Committee regularly evaluate the size and composition of the Board to ensure appropriate alignment with the Company’s evolving business and strategic needs. |

Director Succession Planning |

The Corporate Governance and Nominating Committee reviews the short- and long-term strategies and interests of Applied to determine what current and future skills and experience are required of the Board in exercising its oversight function. |

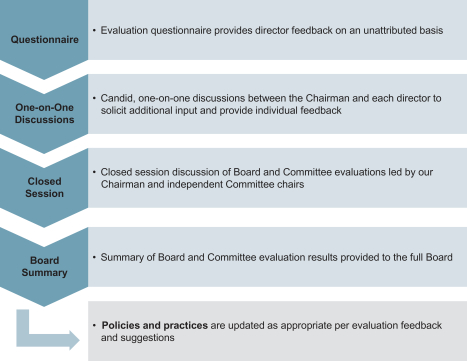

Annual Board Evaluations |

The Board conducts an annual assessment of Board, Board Committees and individual directors to evaluate effectiveness. |

Board Diversity |

The Board values diversity of background, skills and viewpoints, and gender and ethnicity in the recruitment of new directors. |

Board Refreshment |

The Board believes the fresh perspectives brought by new directors are critical to a forward-looking and strategic Board when appropriately balanced by the deep understanding of Applied’s business provided by longer-serving directors. |

We are committed to effective corporate governance that is elected annuallyinformed by our shareholders, promotes the long-term interests of our shareholders, and strengthens Board and management accountability.

Governance Highlights

✓Annual Election of Directors | ✓Shareholder Right to Call a Special Meeting | |

✓Independent Chairman of the Board | ✓Annual Board, Committee and Individual Evaluations | |

✓Highly Independent Board (9 of 10 Directors) and Committees | ✓Robust Board Succession Planning | |

✓Majority Voting for Directors | ✓Regular Executive Sessions of Independent Directors | |

✓No Supermajority Vote Requirements | ✓Active Shareholder Engagement Practices | |

✓Shareholder Proxy Access | ✓No Poison Pill | |

✓Stock Ownership Guidelines for Directors and Executives | ✓Clawback Policy for Annual and Long-Term Incentive Plans |

Shareholder Engagement

We believe that strong corporate governance should include regular engagement with our shareholders to enable us to understand and respond to shareholder concerns. We have a robust shareholder outreach program led by a majoritycross-functional team that includes members of votes cast. Below is summary informationour Investor Relations, Global Rewards and Legal departments. Independent members of our Board are also involved, as appropriate. In the fall, we solicit feedback on our executive compensation program, corporate governance and disclosure practices, and sustainability and corporate citizenship initiatives, as well as any matters voted on at our prior annual meeting. After the filing of our proxy statement, we engage again with our shareholders about each director nominee.important topics to be addressed at our annual meeting. Following our annual meeting, we review the results of the meeting and investor feedback, as well as evaluate emerging trends in corporate governance and other areas. We share feedback we receive from our shareholders with our Human Resources and Compensation Committee, our Corporate Governance and Nominating Committee, and the full Board. See “Shareholder Engagement” on page 12 for more information.

Applied Materials, Inc. iii

Name of Nominee | Age | Director Since | Independent | Committees | ||||||||||

Michael R. Splinter | 64 | 2003 | None | |||||||||||

Gary E. Dickerson | 57 | 2013 | None | |||||||||||

Aart J. de Geus | 60 | 2007 | X | IC, SC | ||||||||||

Stephen R. Forrest | 64 | 2008 | X | IC, SC | ||||||||||

Thomas J. Iannotti | 58 | 2005 | X | HRCC, CGNC | ||||||||||

Susan M. James | 69 | 2009 | X | AC, CGNC (C) | ||||||||||

Alexander A. Karsner | 47 | 2008 | X | CGNC, SC | ||||||||||

Dennis D. Powell | 67 | 2007 | X | AC (C), CGNC, IC | ||||||||||

Willem P. Roelandts | 70 | 2004 | X | HRCC (C), CGNC | ||||||||||

Robert H. Swan | 54 | 2009 | X | AC, IC (C) | ||||||||||

Company Overview

Applied Materials is the leader in materials engineering solutions used to produce virtually every new chip and advanced display in the world. We develop, design, produce and service semiconductor and display equipment for manufacturers that sell into highly competitive and rapidly changing end markets. At Applied Materials, our innovations make possible the technology shaping the future.

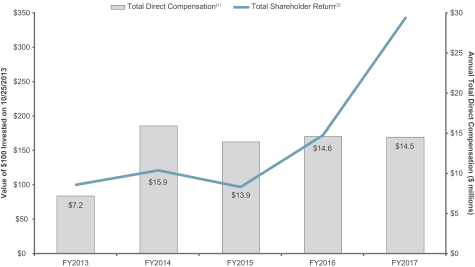

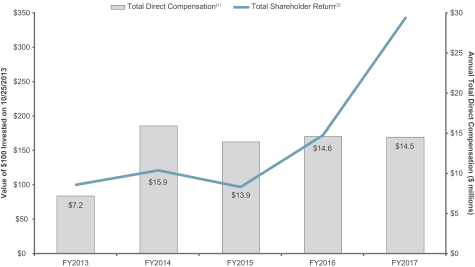

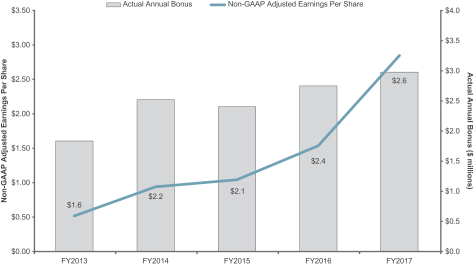

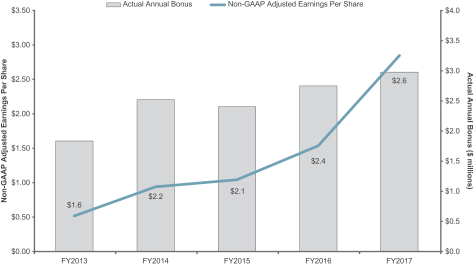

2017 Performance Highlights

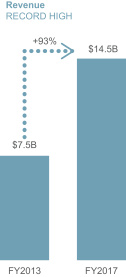

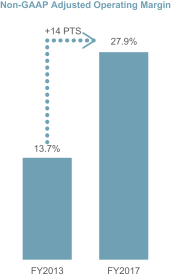

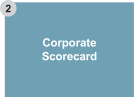

In 2017, we celebrated our 50th anniversary and deliveredall-time record revenue, operating profit and earnings per share.

Key highlights include:

| ● | Grew revenue to $14.5 billion in fiscal 2017, up 34% from the prior year, resulting in our second consecutive year of record revenue; |

| ● | Achieved record revenue across all of our segments; |

| ● | Grew operating profit to a newall-time record, resulting in record GAAP EPS of $3.17, up 106% over fiscal 2016, and recordnon-GAAP adjusted EPS of $3.25, an increase of 86% over fiscal 2016 (see the Appendix for a reconciliation ofnon-GAAP adjusted measures); |

| ● | Delivered record operating cash flow of over $3.6 billion, equal to 25% of revenue; and |

| ● | Returned $1.6 billion to shareholders through dividends and share repurchases. |

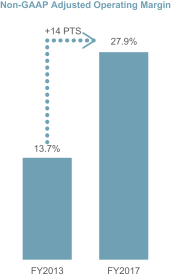

Highlights of five-year performance achievements across key financial measures

|  |  |

Non-GAAP adjusted operating margin andnon-GAAP adjusted EPS are performance targets under our bonus and long-term incentive plans. See Appendix fornon-GAAP reconciliations.

iv 2018 Proxy Statement

Revenue RECORD HIGH $7.5B FY’13 +93% $14.5B FY’17 Non-GAAP Operating Margin 13.7% FY’13 +14 PTS 27.9% FY’17 Non-GAAP EPS RECORD HIGH $0.59 FY’13 +451% $3.25 FY’17

2018 PROXY STATEMENT SUMMARY

Strategic and Operational Highlights

In fiscal 2017, we continued to drive profitable growth by targeting major technology inflections and introducing new, differentiated, enabling products and services to help our customers address their most critical technological challenges.

| ● |

| ● |

| ● |

| ● |

| ● |

Chief Financial Officer Transition.In August 2017, we welcomed a new Chief Financial Officer, Daniel J. Durn, who succeeded Robert J. Halliday. Mr. Durn brings significant industry experience and knowledge that will further accelerate our strategy.

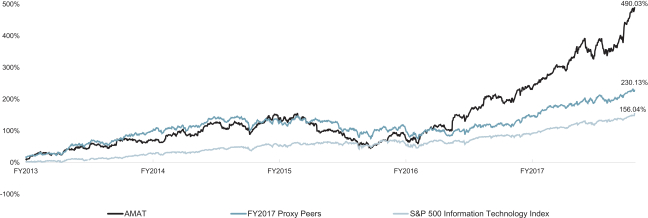

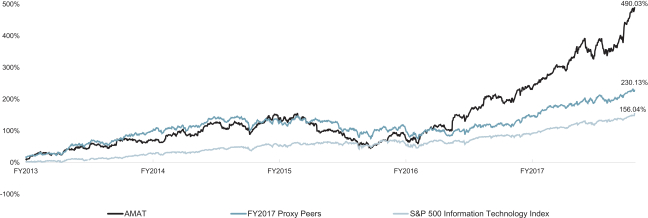

Stock Price Performance

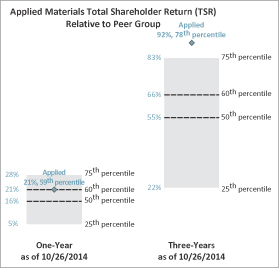

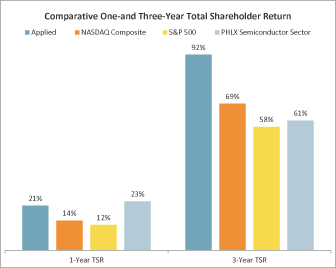

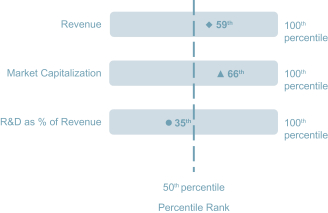

Our strong strategic and financial performance in fiscal 2017 also resulted in meaningful value creation for our shareholders. As illustrated below, Applied significantly outperformed both our peer group and the S&P 500 Information Technology Index.

FY2013 – FY2017 Total Shareholder Return vs. Key Peers

Applied Materials, Inc. v

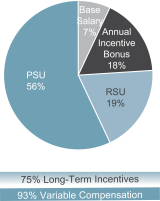

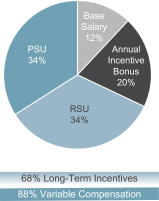

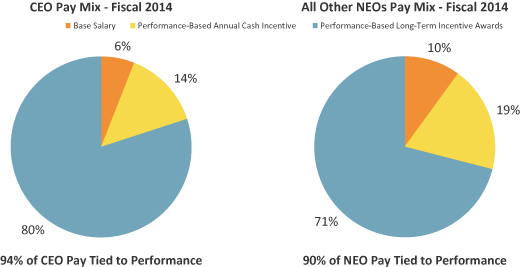

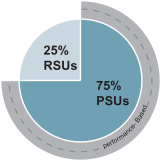

Pay Mix

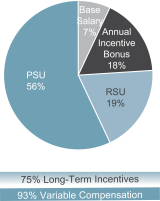

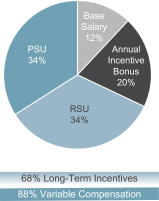

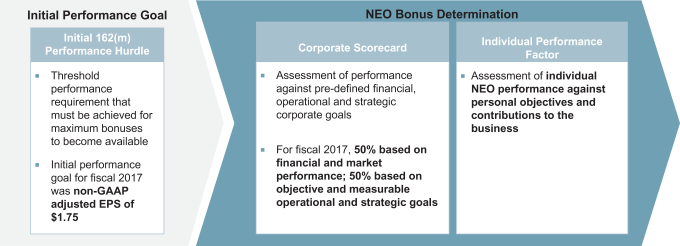

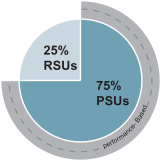

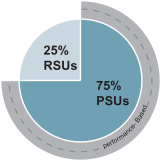

In fiscal 2017, a significant portion of our executive compensation consisted of variable compensation and long-term incentives. As illustrated below, 93% of CEO compensation for fiscal 2017 comprised variable compensation elements, and 75% of Mr. Dickerson’s overall compensation was delivered in equity with multi-year vesting.

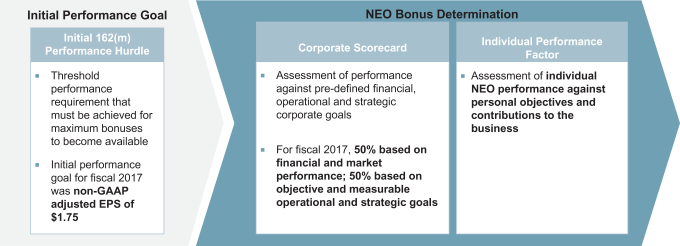

| ||||